If you’re thinking about getting ATV insurance then you’re on the right track. Most people believe they can rely on their homeowners insurance to cover their quad if something happens to it, sadly that’s not true and most people don’t find out until it’s too late.

Since individual ATV insurance policies have become a regular type of coverage over the years, more and more homeowner policies are not covering ATV’s. Now insurance companies can sell you on an additional type of insurance to cover your ATV, UTV and dirt bike. But those old homeowners policies that everyone relied on only covered ATV’s in certain strict circumstances and it didn’t provide the types of coverage ATV owners really needed anyhow. So, in the end, the new individual ATV insurance policies that came about offer way more value to the policy holder.

Not only do you need insurance for your ATV just to make sure your covered and to give yourself peace of mind while your riding. You’ll most likely need proof of insurance to ride in any state or national parks that offer OHV trails. Don’t let a little thing like insurance get in the way of exploring your local parks and recreational riding areas.

After looking at multiple insurance companies I quickly realized that some offered more types of coverage then others. The one company that stuck out the most to me was one we’re all familiar with and that’s Geico. They offer, comprehensive, collision, property damage, bodily injury, medical and uninsured coverage’s in their ATV policies.

Definitions:

Collision coverage – pays for covered damage to the ATV when it hits, or gets hit by, another ATV or vehicle.

Property damage liability coverage – covers you against specified damages caused to someone else’s property while operating your ATV. In most cases, this coverage provides you with a legal defense for such claims if another party files a lawsuit against you.

Bodily injury liability coverage – insures you against certain damages if you end up injuring or even worse, killing someone while operating your ATV. In most cases, this coverage can also provide you with an attorney if another party in the accident files a lawsuit against you.

Comprehensive physical damage coverage – this pays for covered losses resulting from incidents other than collision. Whereas the quad was stolen, was in a fire or someone vandalized it. This is limited to damage that affects the frame or safe operation of the vehicle.

Medical payments coverage – available in most states, you can select medical coverage for yourself and anyone who ride on the ATV/UTV with you.

Uninsured/Underinsured motorists coverage – this covers you against certain damages if you get in a wreck on a public road or highway where you are struck by someone with no insurance or has a policy with limits that are lower than yours. The uninsured vehicle must be a vehicle that is intended to have coverage and is registered for use on a public road or highway.

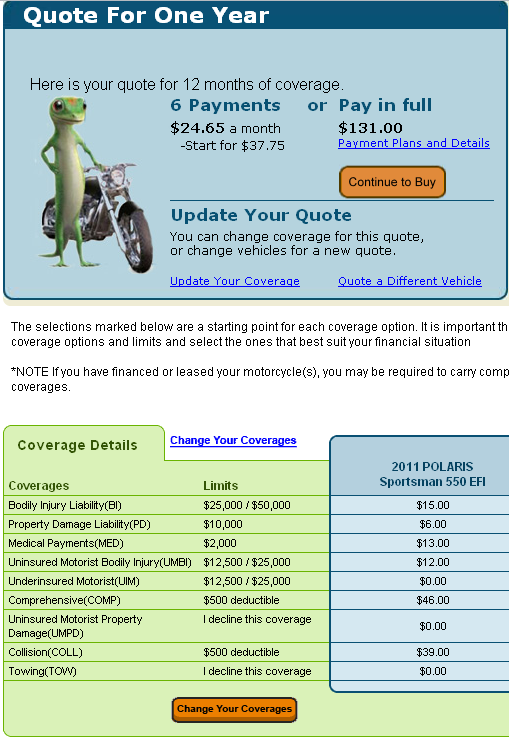

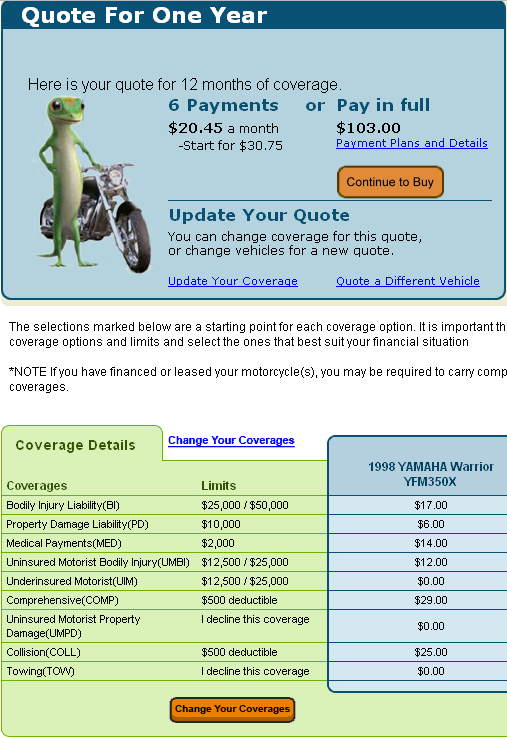

Here I included actual screen shots of insurance quotes from Geico to cover a 2011 Polaris Sportsman 550 and a 1998 Yamaha Warrior. As you can see, I chose two completely different types of quads and the coverage is very reasonable from $103-$131 and that’s coverage for a whole year.

Now, not every person with a 2011 Sportman 550 and a 98 Warrior is going to have the same rate. Rates are influenced by many factors such as, gender, age, driving history, how many bikes are on the policy,how many riders are on the policy, where you live, how the ATV is used and stored and which coverage’s and deductions you select. Little things like aftermarket parts and theft devices can also raise and lower the cost of coverage.

One of the biggest factors of insurance cost simply depends on what model of ATV you’re insuring. Typically they focus on the size of the engine, the bigger the motor the more it cost. They also pay attention to if it’s a sport quad or 4×4. By chance you already have Geico for other types of insurance you’ll already be eligible for a discount.

I hope after reading this you’re more comfortable with the topic of ATV insurance. As you can see, it’s affordable, it’s a no brainer and you deserve to have some kind of coverage if something were to happen to your beloved quad. ATV’s are not cheap to buy and their definitely not any cheaper to buy the second time around if you don’t have insurance to help pay for the one you lost.

There are many companies out there that offer ATV insurance. Chances are, the insurance company you already work with offers some type of coverage for ATV’s. We simply used Geico as an example because they offer multiple types of coverage with lots of choices in level of coverage. Find one that suites your needs and ride safe.

To get your quote, click here GEICO